Rocky Mountain Credit Union

Rocky Mountain Credit Union (RMCU) is a medium-size credit union of about $220 million in assets, operating in a 7 county charter area with a population of approximately 200,000 people. When Prime Inc. took over the marketing for RMCU in 2015, the average member age was 68, and the credit union wanted to better relate to a Millenial audience. We went to work establishing a new brand position for the credit union. This including using a younger voice for the credit union, defining the importance of belonging to a community-owned organization, and rebranding products targeted at Millenials.

The Deliverables

Brand Positioning and Strategy

Updated Brand Identity and Visuals

New Messaging and Content

Website Launch and Hubspot Integration

Campaign Planning and Management (Product and Annual Initiatives)

Digital Marketing Strategy (SEO, Content Strategy, Email Drip Campaigns, Social Media Engagement, Digital Ad Placement)

Traditional Ad Placement Strategy (Direct Mail, Print and Radio)

Print Marketing Materials (Brochures, Deposit Inserts, In-branch advertisements)

Annual Planning, Monthly Reporting, and General Account Management

Today the credit union average member age is 47. We've had a steady 10% growth in membership each year and over $1.3 million in deposit growth. RMCU has been fully integrated with Hubspot, joining the Inbound marketing movement. Each month we typically see 5% growth in web traffic with strong growth in leads for Mortgage, Auto Loan, and Commercial loan products.

Explore the Product Marketing Campaigns Below!

Home is Where Our Heart is...

Mortgage advertising should come with a side of feelings. Check out the approach to growing market share for mortgages in a saturated market.

We’re Not a Regular Credit Union, We’re a Cool Credit Union

We rebranded consumer loans at Rocky Mountain Credit Union and took it to the next level.

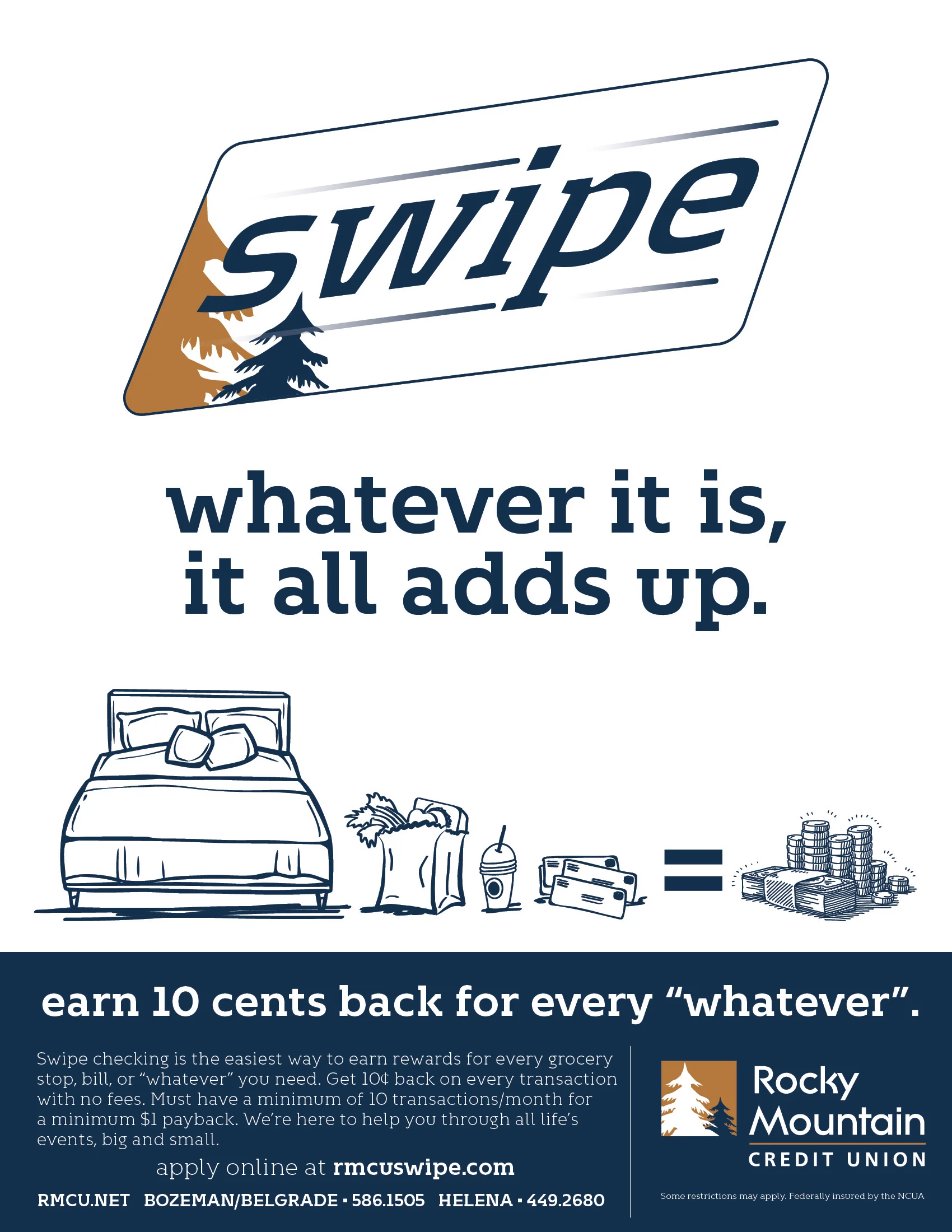

RMCU SWIPE CHECKING GETS A MAKEOVER

Your life isn’t boring and your check account shouldn’t be either. Heres the creative approach to marketing a cash-back checking account to Millennials and Gen X audiences.

COIN CHECKING FOR MILLENIALS

Targeted at young Millenials who would be starting there first checking account, we took a light-hearted approach to the creative messaging. We portrayed the “Coin” checking accounts like the plots of a movie, because you’re the main character and your checking account is a support role.

RMCU's Guide to a Great Summer

The push to capture more of the consumer loan market developed the “Summer Guide” campaign. We packaged RMCU’s consumer loan products into one holistic way to have a great summer. This campaign ran for 4 months, illustrating the summer activities popular within the Rocky Mountain region. The creative is bright and light-hearted, much like the feelings of summer. This comprehensive campaign included both traditional methods (deposit inserts, posters, direct mail, print ads, radio) and digital methods (social media ads, blogs, email drip campaigns, and content offers - see the summer budgeting worksheet). The outcome? Well RMCU saw a 30% increase in consumer loans. Sometimes it’s just about the way you frame your product and speak to your audience. This light-hearted campaign did just that.